Illegal Market Manipulation: The New Frontier Of Securities Fraud

Introduction

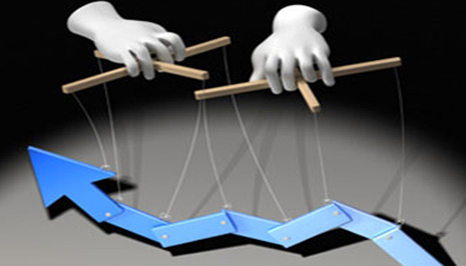

The securities market is one of the most important drivers of the global economy. It is also one of the most vulnerable to fraud and abuse. Market manipulation is a type of securities fraud that involves artificially inflating or deflating the prices of securities to produce a profit. This type of fraud is often difficult to detect and prosecute because it does not involve traditional forms of deception, such as insider trading or accounting fraud.

In spite of the difficulties, it is of the utmost importance to be knowledgeable about this kind of fraud and the measures that may be taken to protect oneself from becoming a victim of it. This article will provide an overview of market manipulation, including a definition of market manipulation as well as information on who engages in market manipulation, why market manipulation is illegal, and how market manipulation can be prevented. The article will also provide information on who engages in market manipulation. In addition to this, the article will include information on the individuals that manipulate market prices. In addition to this, the essay will offer details about the people who are responsible for manipulating market pricing.

Market Manipulation

Market manipulation is a type of fraud that involves artificially inflating or deflating the prices of securities. This type of fraud is a form of price manipulation, and it is illegal under both federal and state securities laws. Market manipulation typically includes activities such as using false or misleading information to influence the price of a security or actively trading in a security in order to drive up its price.

The US Securities and Exchange Commission (SEC) has taken a harder stance on market manipulation in recent years, as rising technology has enabled more sophisticated and lucrative forms of market manipulation. These activities include engaging in high-frequency trading and exploiting newly available sources of market data. Such activities are often difficult to detect and can lead to millions of dollars in losses for investors.

Who Commits Market Manipulation?

Market manipulation can be perpetrated by corporate insiders, as well as by investors and traders. Corporate insiders, including directors, officers, and employees, have access to inside information that gives them an advantage over other investors. This kind of information can be used to drive up the price of a security and then sell it before the information is made public.

Investors and traders can also use market manipulations to their advantage. These actions can include trading on one stock while simultaneously betting on another, buying or selling a large number of shares at the same time, or conducting wash sales or phony transactions to create the illusion of liquidity. All of these activities are illegal under US securities laws.

Why is Market Manipulation Illegal?

Market manipulation is illegal because it distorts the normal price movements of a security. This type of fraud undermines investor confidence and can create losses for those who do not know what is really going on. It can also be used to create false investments or pump-and-dump schemes, which are specifically illegal under US securities laws.

Market manipulation is also a form of experience fraud, as it can often be difficult to detect and prosecute. This creates an unfair playing field for investors, who may have already lost money to a fraudulent stock before it is discovered. As such, the SEC has been increasingly cracking down on offenders in recent years.

How Can Market Manipulation Be Prevented?

The best way to prevent market manipulation is to stay informed and Insider trading activity monitoring. It is important to understand the securities laws and the risks involved in investing. Investors should also be on the lookout for signs of Market manipulation, such as abnormally active trading in a particular stock or sudden changes in price. Investors should also be aware of the potential for insider trading and other forms of fraud.

Many investors use online brokers to buy and sell securities, so it is important to make sure that the broker is registered with the SEC. Finally, investors should ensure that they are dealing with a legitimate broker or agent by doing some research into their background and credentials.

Conclusion

Those who are discovered to be engaging in the unlawful practice of manipulating the market are considered to be guilty of securities fraud, which is against the law and carries significant legal repercussions for those who are proven to be guilty of the crime. Despite the fact that it can be difficult to uncover and prosecute cases of fraud of this nature, there are actions that can be done to assist in protecting oneself from becoming a victim of this type of fraud. These actions can be done to protect oneself from becoming a victim of this type of fraud.

One can protect themselves from becoming a victim of this kind of fraud by following these preventative measures. By adhering to these precautionary procedures, one is able to protect themselves from being a victim of the kind of deception that has been described. The following are the steps that need to be done in order to complete this task: You may prevent being taken advantage of in the market by keeping up with current events, conducting background checks on prospective brokers or agents, and keeping a vigilant eye on your investments for symptoms of fraudulent behavior. One tactic you can use to protect yourself from being taken advantage of in the market is to keep yourself informed about what is going on in the world at the present time. For the sake of your own personal safety, you should undoubtedly take each and every one of these steps.