Financial Literacy: A Tool for Our Next Generation

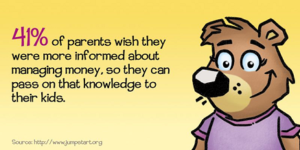

The need for education and understanding of different aspects is very important. Financial literacy is among that which helps the children to get an idea of financial concern from an early age.

This excerpt will provide a credible syllabus that provides the whole skeleton of the financial literacy concepts. The children who are from four to seven years of age get specific learning goals that make them understand different concepts. Below mentioned is the syllabus for the SpendSafe financial literacy for children of age group four to seven years.

Skeleton of the syllabus for age below three years

- Giving the scope of taking a decision is very important at the initial stage, parents take a decision but gradually it is prescribed to make the children able to decide on simple selections. These lessons constitute a guided decision regarding the money related issues to those children who are in kindergarten or pre-school. This is the first step that provides an understanding of financial issues to them.

- The next step of financial literacy to the children is to get a grab of spending habits. This spending habit provides an early categorization of investing money. This sequential concept helps people to save, spend, and share. This is one of the most important aspects while learning about financial literacy.

- The core attribute that should be understood by our future generation at a very initial stage is to get an idea of wants and needs. This helps them to get an understanding of the money that it is earned and not comes free from anywhere else. This strengthens the foundation of the little ones and provides them with the core knowledge that works and money go side by side. It is more important to indulge than in activities in the home that can act as a job which in turn provides them money. This will help them in getting a sense of earning money. Preschool-aged children should get knowledge of financial goals. They should finalize that there with the help of work they can attain more. This is amongst the most important parts of financial literacy as all the things depend on this aspect only. It is just making them understand that they are getting rewards in exchange for the work or job they perform.

- It is very important to get a grab of the core money. They should get an understanding that money is the medium of exchange for all goods and services. This section makes them aware of the different currency modes such as coins, paper money, cheques, etc. this lesson helps the children to get effective knowledge about the purchasing power of money. In addition to that this module consists of different activities that make them acquire all the knowledge.

This is the core strategy and syllabus for providing financial literacy to the children who are in pre-stage. By that, the children who are in three to six grades should also get an understanding of financial literacy. This course gradually transforms their tender mind to grab all the important things about finance.

The crux of the syllabus for 3-6 years

The next part provides all the skeleton of the syllabus for these age groups. This age group specifically contains the methods for children from third grade, fourth grade, fifth grade, and sixth grade.

- The lesson one in this curriculum includes allowances and spending plans. These spending plans are categorized into three small methods such as spend, save, and give. It correlates all of them as it is very important to spend while the weightage of saving couldn’t be denied. If they are getting the information at an early stage, then it is going to be very fruitful. This lesson makes them aware of different kinds of allowances and additional income. It also keeps a check on making them understand about the saving and spending options.

- Responsibility for keeping money and using them wisely is very important. At a tender age, it is quite evident that one should start managing things. This module consists of a demonstration of worksheets through keeping a record sheet at every point of expenditure. This helps in tabulation for the expenditure.

- Saving money and investing it in a high return option is very important, this module is related to that. In this, the students are getting aware of the world of investment. Not only the investment, but they also get exposure to how to invest. Though they also get an idea about the failure associated with the investment. It is not mandatory to always gain. They should be ready for any kind of situation. This lesson is capable of providing the idea of how the basics of investment work. It also makes them aware of different kinds of financial risks associated with investment and also the rates of return.

- Getting an understanding of choosing and buying is very important. It is crucial to be decisive for choosing things and investing in them. Students are given different activities that help them to observe and scrutinize the activities so that they can compare and then invest it wisely.

These are the syllabus or the skeleton of the courses provided for the students so that they can get an apt understanding of financial literacy. Being financially literate is very important at this time. Spendsafe helps the user to provide these curriculums. If your child does not understand the core effect of this, then it is going to be very hard in the future. You should help them to understand these as it is going to the pedestal on which life goes on.

(This article was written by SpendSafe Inc., Canada)