Financial systems vary in each country. However credit score is one of the most important and commonly used number/statistical measure…

United States

Let’s say you’re working and earning money in the United States but you don’t qualify for a Social Security Number…

The U.S. auto insurance system can be confusing for someone who is just starting to drive or who has just…

If you are a foreign visitor to the United States, have a valid visa, and want to drive a car…

In the United States, the ITIN is a tax identification number. It is used by migrants who are not eligible…

In the United States of America, the ITIN is a tax identification number. It is used by foreigners who are…

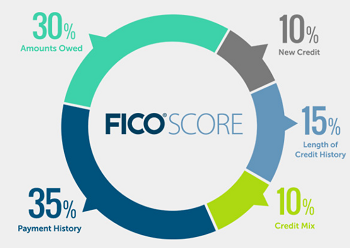

A credit score is a score between 300 and 900 points that is used to determine the likelihood that a…

A home mortgage is a loan that is used to buy, refinance, or renovate the same property that secures the…

Health insurance in the United States is mostly bought privately. Although the United States is the country where the greatest…

Credit card companies across the global use various kinds of identification to check card applicant’s credit history in order to…