Many people face confusion in understanding the terminologies Aadhaar Linking and Aadhaar Seeding. Although the name sounds same, the objectives…

UIDAI The Unique Identification Authority of India (UIDAI) is encouraging citizens holding Aadhaar card to review their Aadhaar information. And…

Starting a business in an area that you are really passionate about, helps an individual align personal dream with the…

We live in a globalized world where we everyday encounter consumerism i.e. attraction for material things such as latest gadgets,…

Children have a long way to go and a lot to learn. What is the need to educate them with…

Practically all banking processes and services rely on computer systems. And the technology used for information processing is one of…

Everyone should be prepared for the challenges and stages of life before they happen. However, we learn from our mistakes…

With a fortune valued at more than $82 billion, Warren Buffett is one of the most successful and famous investors…

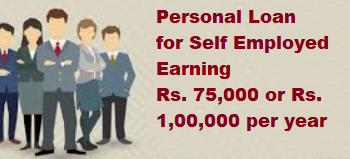

For years we have been taught that applying for a personal loan is a mistake for our personal finances. And…

Many individuals seeking personal loan have myth that the minimum income required for personal loan is always high and that’s…