Sukanya Samriddhi: Invest 140000, Get 526051 (276% RoI)

Sukanya Samriddhi Yojana for a girl child has started getting a very good interest amongst parents as the scheme aims to secure girl’s future by offering very good interest rate. The scheme required a minimum deposit of Rs.1000 to start with and maximum of Rs.1,50,000 (1.5 lakh).

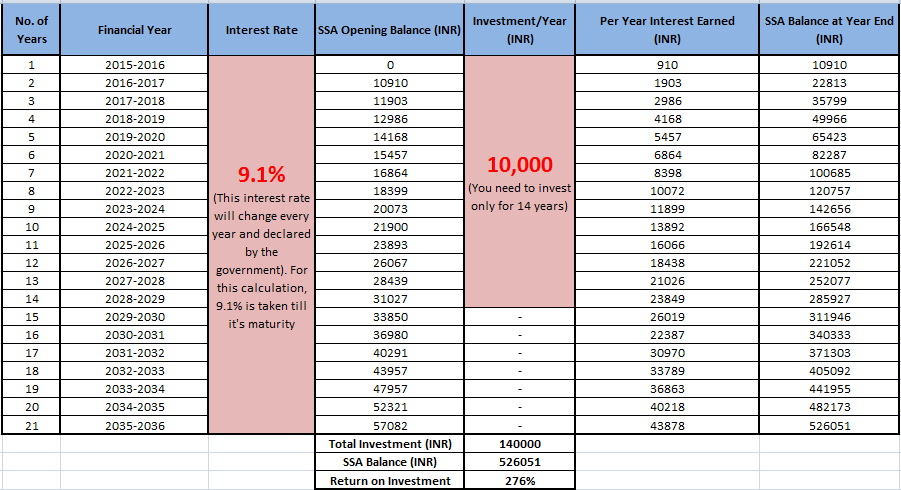

So let’s see how a deposit of Rs.10,000 every year (starting from the financial year 2015-2016) till 14 years will earn you Rs.5,26,051 which is a whopping 256% return. I’ve assumed 9.1% interest rate for the whole period which might change and will be declared by the government every financial year.

Here’s a table displaying yearly investment and interest amount earned:

So as you can see how your money grows every year in this small savings scheme. The returns would be on higher as you invest more money considering that you invest for a long term.

Note: You can also start investing in current financial year 2014-2015 i.e. before 31st March 2015 and still get income tax benefit which will help while declaring investment.

One of the biggest benefit which is attracting more and more people to this scheme is that the returns and investments are 100% tax free. Read all the features of SSA. It has been seen that parents are differentiating SSA with PPF since they almost carry similar features. This according to me is incorrect as objective of both these schemes are different. Check out 18 differences between PPF and SSA, which will give you a clear picture.

You can open this account in government post offices and 28 Indian banks (public & private) authorized by Reserve Bank of India. Also read how to get application form available at post offices and the images of SSA passbook.

r bhardwaj

I want to open my cousin sister’s account she is 09 years old.

how can open dis

plz brief.

Dinesh yadav

Minimum How many money deposit in a one year

SOMENDRA KUMAR VERMA

Hello friends,

If i open account by 4000 per month ie 48000 per year. after 21 yrs. what amount my child will get.

is there any calculator of this scheme.

AllOnMoney.Com

Dear Somendra, on maturity you will get Rs. 2,562,068 assuming 9.2% interest is fixed. However the interest may change every year by the Indian government.

Abhijit Srivastava

Hello Narendra,

This is not a place for discussing this type of thing. We should help others to open this scheme so that people will get benefit from this scheme. This is very good scheme for girl child doesn’t matter which Govt is there. So please help others rather than blaming to Govt.

Hello Jagmeet,

Yes in case of death of the child before the maturity of account, amount with interest till date will be withdrawn by Legal Gaurdian.

Thanks

Abhijit Srivastava

narendra

Its benefit in terms of tax.people are saying that just invest 10000 year – 140000 and will get 500000 boss if u go with local bank co-operative bank u will get 10% compound interest and if u calculate it will be all most same because govt. is keeping 140000 for another 7 years and people forget that.

secondly we can’t trust our government as some government people starts saying that ppf withdrawal will be not tax free so if in future if happens with this then who will take responsibility.

Our government is not trust able. and we know our corrupt ministers well.

narendra

Jagmeet Singh

For Sukanya Samridhi, In case of death of child before the maturity of account, can the amount be withdrawn by Parents

Abhijit Srivastava

Yes i am already doing the same thing. Auro ka bhi bhala ho jaye…. 🙂

Abhijit Srivastava

Hello,

I opened Sukanya Samridhi Account in SBI today (22-May-2015)

Thanks All

AllOnMoney.Com

Congratulations Abhijit. Please spread the news and ask every known person to you to open the account. Thank you.

dinesh

if a girl starts the account at the age of 14 and pay upto 14 years, can be withdrawn the maturity amount at the age of 24.

Abhijit Srivastava

Hello,

I need a small help. Can i open this account in State Bank Of India or i need to wait some time.

Thanks

Abhijit Srivastava

AllOnMoney.Com

Dear Abhijit, as of now no Indian banks have started to open the account. I’d visited SBI personally to open the account but they do not have any update about this scheme.

pannu

Good sacim

Last date kab tak hai.

AllOnMoney.Com

Hello, there is no last date. You can open account anytime. Thank you.